Private Equity’s Secret Weapon: Why Human Capital Is Now the #1 Driver of Investment Success

Jim Beqaj, one of the country’s top human capital experts, reveals why PE firms are doubling down on talent strategy—and what happens when they don’t.

PALM BEACH, FL, UNITED STATES, March 5, 2025 /EINPresswire.com/ -- The private equity world is undergoing a fundamental shift—investment success is no longer just about financial engineering, it’s about people. With talent shortages, leadership misalignment, and cultural integration issues threatening portfolio performance, PE firms are now making human capital their top priority.

Over the years, PE firms have become exceptionally precise in financial modeling, operational efficiency, and risk mitigation. Advanced data analysis, AI-driven forecasting, and refined deal structures have enabled firms to de-risk acquisitions and maximize returns. But there’s one factor no model can predict, no algorithm can optimize, and no financial projection can guarantee—people.

A recent PE Leadership Survey from AlixPartners confirms this shift:

📌 81% of portfolio company executives say recruiting and retaining talent is their biggest challenge.

📌 41% of private equity firms cite the war for top talent as a key concern.

📌 The most sophisticated firms are embedding human capital strategy into every phase of the deal cycle.

"Private equity firms have mastered financial engineering," says Jim Beqaj, TEDx speaker, best-selling author, and one of North America’s top human capital advisors. "They know how to identify high-potential businesses, structure deals, and scale operations. But the one variable they can’t fully control—the one thing AI and financial models can’t predict—is people."

The $100 Million Mistake: When Human Capital Becomes the Weak Link

Beqaj warns that neglecting human capital can silently erode deal value:

🚨 Executive turnover disrupts performance – Without a structured leadership retention and alignment plan, new ownership can trigger a wave of key departures, taking institutional knowledge and relationships with them.

🚨 Culture clashes stall growth – PE-backed companies often struggle when new leadership doesn’t align with existing teams, leading to disengagement, resistance, and a slowdown in execution.

🚨 Lack of a human capital plan kills scalability – Without clear talent strategies, PE firms risk underestimating leadership gaps, mismanaging workforce integration, and failing to attract top-tier talent to drive aggressive growth plans.

"Private equity is all about unlocking value," says Beqaj. "And now that firms have eliminated nearly every other acquisition risk, the last competitive advantage left is getting the people part right."

Why Smart PE Firms Are Bringing in Human Capital Experts:

To combat these risks, leading PE firms are hiring human capital specialists to integrate talent strategy into every stage of the investment lifecycle. This means:

✅ Building leadership assessment into due diligence – Evaluating C-suite capabilities, cultural fit, and talent pipelines before acquisition.

✅ Aligning leadership post-acquisition – Implementing executive coaching, compensation restructuring, and performance-driven incentives to keep key players engaged.

✅ Future-proofing portfolio companies – Developing succession plans, talent development pipelines, and high-performance cultures that drive sustained growth.

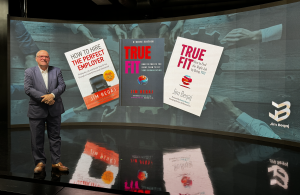

Beqaj, a trusted advisor to private equity firms, provides expert guidance on optimizing leadership and talent strategy. His upcoming book, True Fit C-Suite Edition (May 2025), is a blueprint for hiring and developing executive teams that drive real financial value.

“My TEDx talk on hiring in today’s evolving business world has resonated with thousands of executives," Beqaj adds. “The way we build teams is changing, and private equity firms that get it right will have a major competitive advantage.”

About Jim Beqaj

Jim Beqaj is one of North America’s leading human capital experts, specializing in executive hiring, leadership development, and high-performance team building for private equity-backed firms. A TEDx speaker and best-selling author, Beqaj’s insights into hiring and leadership have helped companies transform the way they approach talent acquisition.

A former President & COO of Wood Gundy, Beqaj has personally hired over 900 executives and works with top private equity firms to ensure leadership alignment and talent optimization in their portfolio companies.

His upcoming book, True Fit C-Suite Edition (May 2025), delivers PE-focused insights on how to hire, develop, and retain elite leadership teams.

For more information or to connect with Jim Beqaj, visit www.jimbeqaj.com.

Brant Pinvidic

Invelop Entertainment

+1 310-435-1535

email us here

Visit us on social media:

Facebook

LinkedIn

Instagram

YouTube

Jim Beqaj Talks Private Equity and Human Capital

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Companies

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release