Equity Access Group Reveals Must-Have Reverse Mortgage Checklist for 2025

Equity Access Group has introduced the 2025 Reverse Mortgage Application Checklist, simplifying the process for retirees to access home equity with ease.

LADERA RANCH, CA, UNITED STATES, December 12, 2024 /EINPresswire.com/ -- As living costs continue to rise and retirement dynamics shift, more seniors are considering reverse mortgages as a way to access home equity. However, the application process can be challenging. The new checklist is designed to provide a step-by-step guide, ensuring retirees can approach the process with greater confidence and transparency.

“Retirement is a pivotal time, and seniors deserve resources that enable them to make informed financial decisions,” said Jason Nichols, Chief Marketing Officer at Equity Access Group. “This checklist is a practical tool that supports retirees in achieving financial clarity and peace of mind.”

Key Features of the 2025 Reverse Mortgage Application Checklist:

The checklist is organized into ten comprehensive steps, helping seniors navigate every phase of the reverse mortgage application process:

1. Determine Eligibility: Applicants must meet age and residency requirements and ensure their home meets equity and maintenance standards.

2. Understand Loan Options: Retirees can explore various disbursement methods, including lump sum payments, monthly installments, or a line of credit.

3. Gather Necessary Documentation: Required documents include government-issued identification, proof of income, and property-related records.

4. Schedule Mandatory Counseling: Counseling sessions with HUD-approved agencies are required to ensure applicants fully understand the terms of their loan.

5. Complete a Financial Assessment: Applicants must demonstrate financial stability and address any outstanding credit issues.

6. Conduct a Home Appraisal: An FHA-approved appraiser will assess the home’s value and condition.

7. Submit the Application: Equity Access Group provides dedicated advisors to assist applicants in completing their forms accurately.

8. Review and Finalize Loan Terms: Applicants receive detailed guidance to ensure they fully understand their loan agreement.

9. Close the Loan and Receive Funds: Funds are disbursed based on the applicant’s chosen method, aligning with their financial plan.

10. Post-Loan Guidance: Equity Access Group offers ongoing support to help clients manage responsibilities such as property maintenance and insurance.

Empowering Seniors Through Education and Support:

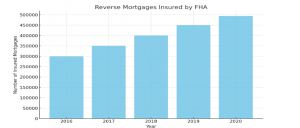

Recent trends indicate an increasing reliance on reverse mortgages to cover essential expenses, such as healthcare and home improvements. By breaking down the application process into clear, actionable steps, seniors can make informed decisions about their financial futures.

Conclusion:

As seniors navigate the complexities of retirement, having the right financial tools is essential for peace of mind and independence. This Reverse Mortgage Checklist simplifies the process, offering clarity and confidence to homeowners seeking to unlock the value of their homes.

About Equity Access Group:

Equity Access Group specializes in providing financial solutions tailored to the needs of retirees. Our mission is to help seniors achieve financial stability and peace of mind through products like reverse mortgages. EAG offers personalized consultations to help you understand the benefits and determine if a reverse mortgage is the right fit for your retirement plan.

Jason Nichols

Equity Access Group

+1 888-391-4324

info@equityaccessgroup.com

Visit us on social media:

Facebook

YouTube

REVERSE MORTGAGES — an expert Mortgage Lender's BEST-KEPT SECRETS

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release