Galaxy Entertainment Group Selected Unaudited Q1 2025 Financial Data

/EIN News/ -- Leading Macau’s Non-Gaming Diversification Through Mice, Entertainment And Sporting Events

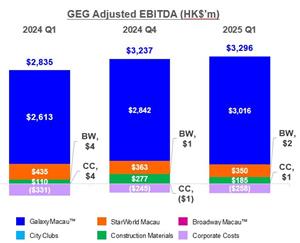

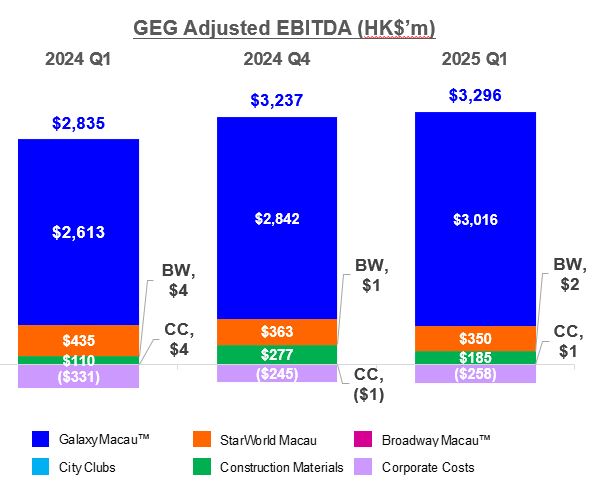

Q1 2025 Group Adjusted EBITDA Of $3.3 Billion,

Up 16% Year-on-Year, Up 2% Quarter-on-Quarter

Soft Launched Capella At Galaxy Macau in May

A Final Dividend Of $0.50 Per Share Payable June 2025

HONG KONG, May 08, 2025 (GLOBE NEWSWIRE) -- Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported results for the three-month period ended 31 March 2025. (All amounts are expressed in Hong Kong dollars unless otherwise stated)

Mr. Francis Lui, Chairman of GEG said,

“Today I am pleased to report solid results for GEG in Q1 2025. During the quarter we continued to drive every segment of the business in particular the premium mass through our unparalleled products and service, ongoing property enhancements, diverse entertainment shows and events, as well as the full implementation of smart tables, among others.

In Q1 2025 the Group reported Net Revenue of $11.2 billion, up 6% year-on-year and down 1% quarter-on-quarter. Adjusted EBITDA was $3.3 billion, up 16% year-on-year and up 2% quarter-on-quarter. We were satisfied with our casinos’ performance over the Chinese New Year and in particular the post Chinese New Year which experienced a longer tail than previously. During March we made a few adjustments to Galaxy Macau™’s main gaming floor adding new electronic games which was partially disruptive for the month.

Despite geo-political turbulence and continued economic slowdown, overall Macau market was still resilient with Q1 2025 Gross Gaming Revenue (“GGR”) of $56.0 billion, up marginally year over year and quarter over quarter, recovering to 76% of 2019 level.

Macau’s Chief Executive Mr. Sam Hou Fai delivered his first Policy Address last month, reiterating that Macau will continue to implement the plan for the development of a diversified economy, to promote the ‘1+4’ diversified industries and accelerate the development of the Hengqin Deep Co-operation Zone. The Government will also guide the concessionaires to make their non-gaming investments effective and to put more resources into supporting development projects in Macau and Hengqin. As always, GEG will support the Government’s policies and the goal to develop Macau into the World Centre of Tourism and Leisure.

The Group’s balance sheet remains healthy and liquid, with cash and liquid investments increasing to $33.0 billion. The net position was $29.0 billion after deducting debt of $4.0 billion. This financial strength allows us to fund our development pipeline, explore overseas opportunities and return capital to shareholders via dividends. The GEG Board previously recommended a final dividend of $0.50 per share payable in June 2025. This demonstrates our continued confidence in the longer-term outlook for Macau in general and in GEG specifically.

We continue to leverage our competitive advantage of our extensive non-gaming amenities including: our retail, food & beverage, multiple hotels brands, Grand Resort Deck, MICE facilities and Galaxy Arena. Entertainment shows and events continued to play a key role in driving new and repeat customers to Macau. In the first quarter alone, we hosted a number of significant events at the Galaxy International Convention Center (“GICC”) and Galaxy Arena such as 2025 TF Family New Year Concert, Jeff Chang World Tour Concert, for K-pop we had BIGBANG’s lead singer Taeyang 2025 Macao solo Tour and BLACKPINK’s member JISOO solo Asia Fan Tour, as well as the world-renowned Italian tenor Andrea Bocelli’s Concert, among others. During the first quarter we experienced a 64% year-on-year increase in Galaxy Macau™’s foot traffic which we believe was driven largely by our diverse non-gaming amenities and entertainment offering.

GEG is well positioned to continue capitalizing on this trend of increased entertainment in Macau with Macau’s largest indoor coliseum - Galaxy Arena. In April we hosted ITTF World Cup Macao 2025, one of the world’s most prestigious table tennis events, which received overwhelming demand. Just the past weekend we successfully hosted the Wakin Chau World Tour. Later in May we will be having J-hope, a member of the globally acclaimed K-pop group BTS, who is set to bring his first solo world tour to Galaxy Arena. Additionally, in June we will host BIGBANG leader G-Dragon’s first concert tour in eight years and the highly anticipated Jacky Cheung 60+ Concert Tour, as well as the Extraordinary General Assemblies and Conference of the Fédération Internationale de l’Automobile which is co-organized by Automobile General Association Macao-China and GEG, marking the first time of this world class annual event in Asia.

We will continue to make enhancements to our resorts including adding new F&B and retail offerings at Galaxy Macau™. At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options. StarWorld Macau now hosts one of the largest scale Live Table Games (“LTG”) terminals in Macau.

In the recently announced Michelin Guide Hong Kong Macau 2025 List, four of our restaurants collectively earned five Michelin stars, with Sushi Kissho by Miyakawa, which is founded by celebrated Michelin three-starred Chef Masaaki Miyakawa, winning one star in its first year of operation. Additionally in the Forbes Travel Guide 2025 List, Galaxy Macau™ proved its unrivalled position as an integrated resort with the most Five-Star hotels under one roof of any luxury resort company worldwide for the third consecutive year. Galaxy Macau™ was also named Best Integrated Resort in the Asia Pacific region for the second time by Inside Asian Gaming.

On the development front, the ultra-luxury Capella at Galaxy Macau, the 10th hotel brand in GEG’s portfolio, soft launched in May and we anticipate to have the property fully opened over the next few months. Capella at Galaxy Macau is an all-suite gilded residence, located within Asia’s most luxurious and award-winning resort. Showcasing new standards of bespoke, accentuated luxury, Capella at Galaxy Macau sets the scene for the most discerning of guests to forge authentic connections with Macau – a global entertainment hub with a rich history of culture, UNESCO-world heritage gastronomy and a gateway to the vibrant Greater Bay Area. We also continue to progress with the construction of Phase 4, which has a strong focus on non-gaming, primarily targeting entertainment and family facilities, and also includes a casino.

Meanwhile we continue to evaluate development opportunities in the Greater Bay Area and overseas markets on a case by case basis, including Thailand.

Recently the Macau’s Chief Executive indicated that with the slowing global economy and the potential impact of the recently announced tariffs that in the shorter term it may be difficult to achieve the overall GGR target for 2025. We acknowledge that there are shorter term challenges but remain confident in the longer-term outlook for Macau.

Finally, I would like to thank all our team members who deliver ‘World Class, Asian Heart’ service each and every day and contribute to the success of the Group.”

|

Q1 2025 RESULT HIGHLIGHTS GEG: Well Positioned for Future Growth

|

Macau Market Overview

Based on DICJ reporting, Macau’s GGR for Q1 2025 was $56.0 billion, up 1% year-on-year and up 0.4% quarter-on-quarter, representing 76% of 2019 level.

In Q1 2025, visitor arrivals to Macau were 9.9 million, up 11% year-on-year and up 9% quarter-on-quarter, recovering to 95% of 2019. Mainland visitor arrivals to Macau grew at a faster rate of 15% year-on-year to 7.2 million, with Individual Visit Scheme (“IVS”) visitors of 4.0 million, up 16% year-on-year. Among the Mainland visitors, approximately 0.4 million travelled under the one-trip-per-week visa and approximately 0.1 million under the multiple-entry visa which were implemented at the start of 2025. In addition, visitations from the nine Pearl River Delta cities in the Greater Bay Area increased by 19% year-on-year to 3.6 million. International visitor arrivals to Macau increased by 17% year-on-year to approximately 0.7 million. GEG has continued to work with Macao Government Tourism Office (“MGTO”) to actively promote Macau as a tourism destination. We have opened offices in Tokyo, Seoul and Bangkok.

Group Financial Results

In Q1 2025, the Group posted Net Revenue of $11.2 billion, up 6% year-on-year and down 1% quarter-on-quarter. Group Adjusted EBITDA was $3.3 billion, up 16% year-on-year and up 2% quarter-on-quarter. Latest twelve months Adjusted EBITDA of $12.6 billion, up 16% year-on-year and up 4% quarter-on-quarter.

In Q1 2025, GEG played lucky in its gaming operation which increased its Adjusted EBITDA by approximately $330 million. Normalized Adjusted EBITDA was $3.0 billion, up 7% year-on-year and down 9% quarter-on-quarter.

Summary table of GEG Q1 2025 Adjusted EBITDA and adjustments:

| in HK$'m | Q1 2024 | Q4 2024 | Q1 2025 | YoY | QoQ | ||

| Adjusted EBITDA | 2,835 | 3,237 | 3,296 | 16% | 2% | ||

| Luck1 Normalized Adjusted EBITDA |

63 2,772 |

(35) 3,272 |

330 2,966 |

- 7% |

- (9)% |

||

The Group’s total GGR in Q1 2025 was $10.9 billion, up 14% year-on-year and down 1% quarter-on-quarter. Mass GGR was $8.2 billion, up 6% year-on-year and down 5% quarter-on-quarter. VIP GGR was $2.0 billion, up 52% year-on-year and up 29% quarter-on-quarter. Electronic GGR was $729 million, up 22% year-on-year and down 7% quarter-on-quarter.

|

Group Key Financial Data |

|||

| (HK$'m) | |||

| Q1 2024 | Q4 2024 | Q1 2025 | |

| Revenues: | |||

| Net Gaming | 8,181 | 8,853 | 8,922 |

| Non-gaming | 1,606 | 1,670 | 1,557 |

| Construction Materials | 765 | 771 | 723 |

| Total Net Revenue | 10,552 | 11,294 | 11,202 |

| Adjusted EBITDA | 2,835 | 3,237 | 3,296 |

| Gaming Statistics2 | |||

| (HK$'m) | Q1 2024 | Q4 2024 | Q1 2025 |

| Rolling Chip Volume3 | 38,457 | 51,808 | 46,375 |

| Win Rate % | 3.4% | 3.0% | 4.3% |

| Win | 1,299 | 1,539 | 1,978 |

| Mass Table Drop4 | 31,471 | 32,256 | 32,190 |

| Win Rate % | 24.6% | 27.0% | 25.6% |

| Win | 7,728 | 8,707 | 8,230 |

| Electronic Gaming Volume | 19,043 | 27,464 | 25,562 |

| Win Rate % | 3.1% | 2.8% | 2.9% |

| Win | 600 | 780 | 729 |

| Total GGR Win5 | 9,627 | 11,026 | 10,937 |

Balance Sheet and Dividend

The Group’s balance sheet remains healthy and liquid. As of 31 March 2025, cash and liquid investments were $33.0 billion and the net position was $29.0 billion after debt of $4.0 billion. Our strong balance sheet combined with substantial cash flow from operations allows us to return capital to shareholders via dividends and to fund our development pipeline. The GEG Board recommended a final dividend of $0.50 per share payable in June 2025.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In Q1 2025, Galaxy Macau™’s Net Revenue was $9.1 billion, up 10% year-on-year and flat quarter-on-quarter. Adjusted EBITDA was $3.0 billion, up 15% year-on-year and up 6% quarter-on-quarter.

In Q1 2025, Galaxy Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $345 million. Normalized Adjusted EBITDA was $2.7 billion, up 4% year-on-year and down 7% quarter-on-quarter.

The combined seven hotels occupancy was 99% for Q1 2025.

|

Galaxy Macau™ Key Financial Data |

|||

| (HK$'m) | |||

| Q1 2024 | Q4 2024 | Q1 2025 | |

| Revenues: | |||

| Net Gaming | 6,887 | 7,665 | 7,762 |

| Hotel / F&B / Others | 1,056 | 1,127 | 1,052 |

| Mall | 371 | 348 | 335 |

| Total Net Revenue | 8,314 | 9,140 | 9,149 |

| Adjusted EBITDA | 2,613 | 2,842 | 3,016 |

| Adjusted EBITDA Margin | 31% | 31% | 33% |

| Gaming Statistics6 | |||

| (HK$'m) | |||

| Q1 2024 | Q4 2024 | Q1 2025 | |

| Rolling Chip Volume7 | 37,433 | 50,862 | 44,371 |

| Win Rate % | 3.3% | 3.0% | 4.4% |

| Win | 1,243 | 1,522 | 1,941 |

| Mass Table Drop8 | 24,472 | 25,443 | 25,270 |

| Win Rate % | 26.2% | 29.3% | 27.8% |

| Win | 6,406 | 7,465 | 7,027 |

| Electronic Gaming Volume | 12,779 | 17,792 | 16,333 |

| Win Rate % | 3.8% | 3.4% | 3.5% |

| Win | 487 | 611 | 570 |

| Total GGR Win | 8,136 | 9,598 | 9,538 |

StarWorld Macau

In Q1 2025, StarWorld Macau’s Net Revenue was $1.2 billion, down 9% year-on-year and down 4% quarter-on-quarter. Adjusted EBITDA was $350 million, down 20% year-on-year and down 4% quarter-on-quarter.

In Q1 2025, StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $15 million. Normalized Adjusted EBITDA was $365 million, down 13% year-on-year and down 2% quarter-on-quarter.

Hotel occupancy was 100% for Q1 2025.

|

StarWorld Macau Key Financial Data |

|||

| (HK$'m) | |||

| Q1 2024 | Q4 2024 | Q1 2025 | |

| Revenues: | |||

| Net Gaming | 1,235 | 1,152 | 1,118 |

| Hotel / F&B / Others | 128 | 131 | 119 |

| Mall | 6 | 6 | 5 |

| Total Net Revenue | 1,369 | 1,289 | 1,242 |

| Adjusted EBITDA | 435 | 363 | 350 |

| Adjusted EBITDA Margin | 32% | 28% | 28% |

| Gaming Statistics9 | |||

| (HK$'m) | |||

| Q1 2024 | Q4 2024 | Q1 2025 | |

| Rolling Chip Volume10 | 1,024 | 946 | 2,004 |

| Win Rate % | 5.5% | 1.8% | 1.8% |

| Win | 56 | 17 | 37 |

| Mass Table Drop11 | 6,756 | 6,620 | 6,734 |

| Win Rate % | 19.0% | 18.4% | 17.4% |

| Win | 1,283 | 1,220 | 1,174 |

| Electronic Gaming Volume | 5,045 | 8,660 | 8,351 |

| Win Rate % | 1.8 | 1.8 | 1.8 |

| Win | 93 | 155 | 146 |

| Total GGR Win | 1,432 | 1,392 | 1,357 |

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs. In Q1 2025, Broadway Macau™’s Net Revenue was $46 million, flat year-on-year and down 21% quarter-on-quarter. Adjusted EBITDA was $2 million, versus $4 million in Q1 2024 and $1 million in Q4 2024.

City Clubs

In Q1 2025, City Clubs’ Net Revenue was $42 million, down 28% year-on-year and up 17% quarter-on-quarter. Adjusted EBITDA was $1 million, versus $4 million in Q1 2024 and $(1) million in Q4 2024.

Construction Materials Division

In Q1 2025, CMD’s Net Revenue was $723 million, down 5% year-on-year and down 6% quarter-on-quarter. Adjusted EBITDA was $185 million, up 68% year-on-year and down 33% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

We continue to make ongoing progressive enhancements to our resorts to ensure that they remain competitive and appealing to our guests including adding new F&B and retail offerings at Galaxy Macau™. We are also ramping up GICC, Galaxy Arena, Raffles at Galaxy Macau and Andaz Macau.

At StarWorld Macau we are evaluating a range of major upgrades, that includes the main gaming floor, the lobby arrival experience and increasing the F&B options. We have completed the upgrade of Level 3 and StarWorld Macau now hosts one of the largest scale LTG terminals in Macau.

Cotai – The Next Chapter

Capella at Galaxy Macau, the 10th hotel brand in GEG’s portfolio, soft launched in early May and we anticipate to have the property fully opened over the next few months. Capella at Galaxy Macau is an all-suite gilded residence, located within Asia’s most luxurious and award-winning resort. Showcasing new standards of bespoke, accentuated luxury, Capella at Galaxy Macau sets the scene for the most discerning of guests to forge authentic connections with Macau – a global entertainment hub with a rich history of culture, UNESCO-world heritage gastronomy and a gateway to the vibrant Greater Bay Area. This 17-storey property offers approximately 100 ultra-luxury sky villas and suites. Each Sky Villa features a light-filled balcony with a transparent infinity-edge pool, outdoor lounge, sunroom and hidden winter garden, among others. Capella at Galaxy Macau promises to bring a new level of elegance and luxury to Macau.

Construction of the 600,000-square-metre Phase 4 is well under way. Phase 4 will include multiple high-end hotel brands new to Macau, together with a 5000-seat theater, extensive F&B, retail, non-gaming amenities, landscaping, a water resort deck and a casino. Phase 4 is scheduled to complete in 2027. We remain highly confident about the future of Macau where Phases 3 & 4 will support Macau’s vision of becoming a World Centre of Tourism and Leisure.

Selected Major Awards in Q1 2025

| AWARD | PRESENTER |

| GEG | |

| 11th Outstanding Corporate Social Responsibility Award Ceremony - Outstanding Corporate Social Responsibility Award | Mirror Post of Hong Kong |

| 2025 Macao International Environmental Co-operation Forum & Exhibition - Green Booth Award | Macau Fair & Trade Association and Macao Low Carbon Development Association |

| GALAXY MACAUTM | |

MICHELIN One-Star Restaurant

|

The MICHELIN Guide Hong Kong Macau 2025 |

Five-Star Hotel

|

2025 Forbes Travel Guide |

| 2025 Black Pearl Restaurant Guide One Diamond - 8½ Otto e Mezzo BOMBANA |

Mei Tuan |

T+L Tastemakers List 2024 (Asia) - Best 25 Restaurants in Macau

|

Travel + Leisure |

BAZAAR Taste Elite 2025 (Macau)

|

HARPERS BAZAAR |

SCMP 100 Top Tables 2025

|

South China Morning Post |

2025 Readers' Choice Awards - Best Macau Hotels

|

Destin Asian |

| STARWORLD MACAU | |

| MICHELIN Two-Star Restaurant – Feng Wei Ju | The MICHELIN Guide Hong Kong Macau 2025 |

FAB Gold List 2024(Asia) - FAB Gold Restaurants

|

fabhotelsasia100.com |

| 2025 Black Pearl Restaurant Guide One Diamond – Feng Wei Ju | Mei Tuan |

| T+L Tastemakers List 2024 (Asia) - Best 25 Restaurants in Macau - Feng Wei Ju | Travel + Leisure |

BAZAAR Taste Elite 2025 (Macau)

|

HARPERS BAZAAR |

| SCMP 100 Top Tables 2025 – Feng Wei Ju | South China Morning Post |

| CMD | |

| Carbon Reduction Action - Participation as Collaborating Partner of Carbon Reduction Action – Certificate | Environmental Campaign Committee |

Outlook

Macau's Chief Executive Mr. Sam Hou Fai has delivered his first Policy Address in April 2025. This Address emphasized that Macau continue to implement the plan for the development of a diversified economy, to promote the “1+4” diversified industries and accelerate the development of the Hengqin Deep Co-operation Zone. The Government will also guide the concessionaires to make their non-gaming investments effective and to put more resources into supporting development projects in Macau and Hengqin. These policies reflect a consistent vision for a more diversified and sustainable development of Macau and its further integration with Hengqin.

We continued to see an increase in Macau’s visitation numbers facilitated by the Mainland IVS extension and further visa relaxation policies such as the one-trip-per-week and multiple-entry visas, as well as improving infrastructure and the continuing joint marketing efforts by the MGTO and the concessionaires to expand the international tourist arrivals. These together brought a larger pool of visitors to Macau and higher hotel occupancy rates. We look forward to further policy relaxation which will further help to revitalize Macau’s tourism.

The rebound in Macau’s visitation with a broader base continued to drive the shift of the Macau gaming industry towards the mass market. GEG is adapting to the evolving tourism landscape by constantly enhancing its non-gaming elements including leisure and entertainment that integrates with our gaming offerings.

In particular, GEG is well positioned to continue capitalizing on the trend of increased entertainment in Macau with Macau’s largest indoor coliseum - Galaxy Arena. Subsequent to Q1, in April we hosted ITTF World Cup Macao 2025, one of the world’s most prestigious table tennis events, which received overwhelming demand. In the past weekend we successfully hosted the Wakin Chau World Tour and later this month we will be hosting J-hope, a member of the globally acclaimed K-pop group BTS, who is set to bring his first solo world tour to Galaxy Arena. Additionally in June we will present BIGBANG leader G-Dragon’s first concert tour in eight years and the highly anticipated Jacky Cheung 60+ Concert Tour, as well as the Extraordinary General Assemblies and Conference of the Fédération Internationale de l’Automobile which is co-organized by Automobile General Association Macao-China and GEG, marking the first time of this world class annual event in Asia.

The adoption of advanced technologies such as smart tables is expected to further enhance the customer’s gaming experience and casino’s operational efficiency. We expect this to enhance game speed, ensure integrity, improve table hold percentages, and refine our customer analytics to provide a more personalized service experience.

Further, the ultra-luxury Capella at Galaxy Macau, the 10th hotel brand in GEG’s portfolio, soft launched in early May. The opening of Capella at Galaxy Macau is set to reshape the market dynamics. With a new level of luxury accommodation in Macau Capella at Galaxy Macau is expected to assist GEG in capturing a larger market share and contribute to the overall growth of Macau with the premium mass market expansion.

We are also progressing well with the construction of Phase 4, which has a strong focus on non-gaming, primarily targeting entertainment and family facilities, and also includes a casino. Our Cotai Phase 4 is the only new development site in Macau and it will further enhance Macau's appeal to tourists, solidifying its reputation as the World Centre of Tourism and Leisure.

Meanwhile we continue to evaluate development opportunities in the Greater Bay Area and overseas markets on a case by case basis, including Thailand.

We acknowledge the recent comments by Macau’s Chief Executive that the 2025 GGR target maybe challenging to achieve. In the shorter term we continue to adjust operations as required, but we remain confident in the longer term outlook for Macau. Macau’s proactive approach in economic diversification combined with China’s firm support, position it well for future sustainable growth.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group Limited (“GEG” or the “Company”) and its subsidiaries (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. The Group primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. GEG is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG through its subsidiary, Galaxy Casino S.A., is one of the three original concessionaires in Macau when the gaming industry was liberalized in 2002. In 2022, GEG was awarded a new gaming concession valid from January 1, 2023, to December 31, 2032. GEG has a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform the market in Macau.

The Group operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award-winning premium property. Galaxy Macau™ was named Best Integrated Resort in the Asia Pacific region for consecutive years by Inside Asian Gaming since the award inauguration and won the most Five-Star hotels under one roof of any luxury resort company worldwide for the third consecutive year in the Forbes Travel Guide 2025 List.

The Group has the largest development pipeline of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will be more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG also considers opportunities in the Greater Bay Area and internationally. These projects will help GEG develop and support Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

___________________________________

1 Reflects luck adjustments associated with our rolling chip program.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects sum of promoter and inhouse premium direct.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 Gaming statistics are presented before deducting commission and incentives.

7 Reflects sum of promoter and inhouse premium direct.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Gaming statistics are presented before deducting commission and incentives.

10 Reflects sum of promoter and inhouse premium direct.

11 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/969fdb28-d022-40e5-87e8-e04096ce0810

For Media Enquiries:

Investor Relations

Mr. Peter Caveny / Ms. Yoko Ku

Tel: +852 3150 1111

Email: ir@galaxyentertainment.com

Distribution channels: Business & Economy ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release