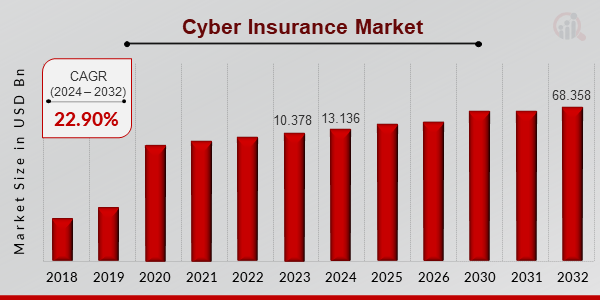

Cyber Insurance Market Projected to reach 68.35 Billion by 2032 | Growth Rate (CAGR) of 22.90%

Cyber Insurance Market Growth

Cyber Insurance Market Research Report Information By Component, Service, Organization Size, End-user, and Region

AZ, UNITED STATES, January 10, 2025 /EINPresswire.com/ -- The global cyber insurance market has witnessed significant growth in recent years and is expected to continue expanding at a rapid pace. In 2023, the market was valued at USD 10.37 billion and is projected to grow from USD 13.13 billion in 2024 to a substantial USD 68.35 billion by 2032, reflecting an impressive compound annual growth rate (CAGR) of 22.90% during the forecast period (2024–2032). This surge in market growth is primarily driven by the increasing frequency and sophistication of cyberattacks, heightened awareness of cybersecurity risks, and the growing need for businesses to protect themselves from financial losses due to cyber incidents.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐲𝐛𝐞𝐫 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐌𝐚𝐫𝐤𝐞𝐭

• Tata Consultancy Services Limited (India)

• Guy Carpenter and Company LLC. (U.S.)

• At-Bay Inc. (U.S.)

• Lloyds Bank PLC (U.K.)

• Cisco Systems Inc. (U.S.)

• AXA SA (France)

• Chubb Limited (Switzerland)

• Apple Inc. (U.S.)

• Zurich Insurance Group (Switzerland)

• Beazley Group PLC (U.K.)

• Lockton Companies (U.S.)

• American International Group Inc. (U.S.)

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 https://www.marketresearchfuture.com/sample_request/8635

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

➤ Rising Cybersecurity Threats

As cyberattacks continue to evolve in sophistication and frequency, businesses of all sizes are at risk of data breaches, ransomware attacks, and other forms of cybercrime. The need for cyber insurance to mitigate financial losses resulting from these threats is accelerating market demand.

➤ Increased Regulatory Pressure

Governments around the world are implementing stricter regulations and data protection laws to ensure that companies protect sensitive customer and business information. Cyber insurance policies help businesses comply with these regulations and avoid heavy fines due to data breaches or security lapses.

➤ Growing Digital Transformation and Dependency on Technology

With businesses increasingly relying on digital platforms, cloud computing, and the Internet of Things (IoT), their exposure to cyber risks has increased. As more businesses transition to digital environments, the need for cyber insurance to protect against potential cyberattacks, system failures, and data breaches is escalating.

➤ High Cost of Data Breaches and Cyberattacks

The financial consequences of data breaches and cyberattacks can be devastating for businesses, including costs related to legal fees, recovery, business interruption, and reputational damage. Cyber insurance provides a safety net to companies, covering these significant costs and reducing the financial impact.

➤ Growing Awareness of Cyber Insurance

As businesses become more aware of the financial risks associated with cyber incidents, the demand for cyber insurance solutions is increasing. Companies are recognizing the need for insurance to cover potential cyber losses and improve their overall cybersecurity risk management strategies.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.marketresearchfuture.com/reports/cyber-insurance-market-8635

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

The global cyber insurance market is segmented based on type, application, region, and industry, providing a comprehensive overview of the market dynamics.

1. By Type:

First-Party Coverage: This coverage protects the insured company from direct losses caused by cyberattacks, such as data breaches, ransomware attacks, or system outages.

Third-Party Coverage: This type of coverage protects businesses from legal and financial liabilities arising from cyber incidents that affect external stakeholders, such as customers or partners.

Liability Coverage: Covers the financial liabilities of businesses for data breaches or other cyber incidents that result in harm to other parties.

2. By Application:

Data Breach & Privacy Liability: Cyber insurance policies often cover the costs associated with data breaches, including notification costs, legal fees, and fines.

Network Security Liability: Coverage for incidents related to network security, including hacking, malware, and other cyberattacks that disrupt business operations.

Business Interruption Coverage: Provides coverage for businesses in case of downtime or operational disruption caused by cyberattacks or system failures.

Errors and Omissions Liability: Covers financial losses caused by the failure of a business’s IT systems, software, or services that were intended to protect customer data.

3. By End-User Industry:

Healthcare: The healthcare industry, which handles sensitive patient information, is one of the most vulnerable sectors to cyberattacks. Cyber insurance helps healthcare organizations mitigate financial risks associated with data breaches and cyber incidents.

Retail and E-Commerce: With the growing shift to online commerce, retailers and e-commerce businesses are increasingly seeking cyber insurance to protect themselves from data breaches, payment fraud, and cyberattacks.

Financial Services: The financial industry is a prime target for cybercriminals due to the high value of financial data. Financial institutions rely heavily on cyber insurance to safeguard their digital operations and customer information.

Government and Public Sector: Government agencies and public sector organizations are investing in cyber insurance to protect sensitive national security data and ensure operational continuity during cyberattacks.

Energy and Utilities: With critical infrastructure at risk, companies in the energy and utilities sectors are opting for cyber insurance to shield themselves from the financial impact of cyber incidents.

4. By Region:

North America: North America dominates the market due to high levels of cyber risk awareness, a large number of businesses investing in digital transformation, and regulatory compliance requirements.

Europe: Europe is witnessing steady growth in the cyber insurance market, driven by the stringent General Data Protection Regulation (GDPR) and the increasing demand for cyber security.

Asia-Pacific: The Asia-Pacific region is expected to experience the fastest growth during the forecast period, with countries like China and India investing heavily in digital infrastructure and requiring cyber insurance solutions to protect businesses.

Rest of the World (RoW): Cyber insurance adoption is growing steadily in regions like Latin America, the Middle East, and Africa, as businesses increasingly face cyber threats and require coverage to mitigate financial risks.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8635

The cyber insurance market is experiencing robust growth, driven by increasing cyber risks, regulatory compliance, and the growing reliance on digital infrastructure. As businesses face escalating threats from cyberattacks, data breaches, and other security risks, the need for cyber insurance solutions to protect against financial losses is more critical than ever. As businesses prioritize securing their digital assets and mitigating potential risks, the demand for cyber insurance will continue to rise, shaping the future of risk management in the digital age.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

High Net Worth Offshore Investment Market - https://www.marketresearchfuture.com/reports/high-net-worth-offshore-investment-market-22960

Lease Accounting And Management Software Market - https://www.marketresearchfuture.com/reports/lease-accounting-management-software-market-23203

Online Powersports Market – https://www.marketresearchfuture.com/reports/online-powersports-market-23212

Car Insurance Market - https://www.marketresearchfuture.com/reports/car-insurance-market-22576

Community Banking Market - https://www.marketresearchfuture.com/reports/community-banking-market-23687

𝐀𝐛𝐨𝐮𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐅𝐮𝐭𝐮𝐫𝐞

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release